As we enter 2023, the tech industry is facing some significant challenges that threaten to slow down tech company revenue growth, not least the recent news about SVB. These challenges are not new, but they are becoming increasingly difficult to navigate as the market evolves and competition intensifies. In this article, we’ll explore some of the key headwinds that tech companies will need to overcome to continue growing their revenue in 2023 in the US market.

Introduction: The Importance of Tech Company Revenue Growth

Tech companies have been leading the charge in global economic growth in recent years, with many achieving remarkable revenue growth. However, with 2023 upon us, tech companies are facing several challenges that could impact their revenue growth. The ability to grow revenue is essential for any tech company’s success, as it enables them to invest in research and development, create new jobs, and contribute to the economy. Therefore, it’s crucial to navigate the headwinds that may slow down tech company revenue growth in 2023.

Sales Teams struggle to Hit Revenue Growth Quotas

Both experienced and new salespeople are experiencing difficult challenges due to the new economic situation. Throughout the consumer journey funnel, we can see how difficult it has become:

- Prospecting: gaining access to the right stakeholders by creating the right segmentation strategy.

- Opportunity: Drive consensus among stakeholders by resolving objections.

- Negotiation: Protect prices and maintain profitability by negotiating via email or direct message.

- Account growth: Manage constantly changing priorities while coping with uncertainty due to the pandemic.

In a survey collected by Bravado, in the face of the economic downturn at the end of 2022, approximately 30% of sales teams reduced their quotas as a precautionary measure. Having missed their current targets, most companies have responded by adjusting their future forecasts downward.

The Impact of Increased instability

To keep in line with declining revenues, companies reduced their forecasts for meeting targets by the end of 2022 by 20%. Even so, due to the stagnating and very likely worsening market, companies are trying to reduce unnecessary expenses and meet future sales targets. Within the tech sector, mid-sized companies only achieved 75% of their revenue targets, forcing them to compensate with a shortfall in the sales team’s budget. This has caused sales teams to shrink by 25% to balance their budgets. Compared to non-tech companies, these targets were often achieved at close to 100% of their revenue targets. It is normal, knowing these numbers, that there have been these massive layoffs in the technology sector. this leaves us with companies not very optimistic about a rebound in 2023.

Mass Layoffs: our Daily Bread and Butter

Due to the economic situation experienced in 2022, approximately 40% of the teams have experienced layoffs. This has affected technology companies to a greater extent and not so much the non-technology companies, 30% of which only have had to do layoffs. We, therefore, see a tendency for technology companies to be affected and collateral damage to non-technology companies due to the overall shrinking of the market. This situation clashes quite a bit with the massive hiring in 2021 by large companies in the reporter. For the conditions for a mass layoff to occur in a sector, several conditioning-third met:

– Laid off one-third of the workforce in 30 days.

– More than 500 employees are laid off in 30 days, regardless of the size of the workforce.

This has resulted in 154,843 employees being laid off in 2022 and 1030 technology companies having to make workforce cuts. The most vocal job cuts in 2022 were at Twitter, with 50% of the total workforce cut in November. This was followed by Snapchat with 20% in September, OpenSea with 20% in July, Masterclass with 20% in June, Cameo with 25% in May and Peloton with 20% in February. Although the change in the unemployment rate is not very significant (from 3.4% to 3.5% in January 2023), what is certain is that the sector that is and will suffer the most layoffs is the technology sector.

An Oasis in the Middle of a Desert

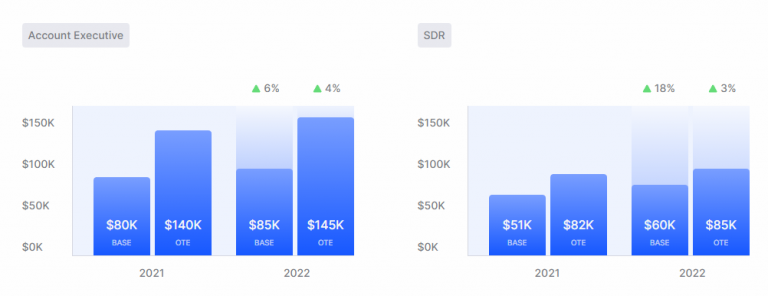

The curious thing about this eclectic situation is the increase in salaries and compensation. Indeed, the increase has not been as exaggerated as in 2021, a period when it seemed that they were giving away money with increases of up to 40%. If we compare both years in the 2 most common jobs in the sales team, we can see the difference:

Source: Bravado

You can see a significant increase of about 20% for SDRs at base salary and a modest increase when targets are achieved. Those with a very modest rise are the Account Executives with increases of 6% in base salary and 4% in salary when meeting quota targets. These salaries, although they have nothing to do with those received for being a software developer, clash with the current situation in a shrinking market.

The Economic Recession Trend

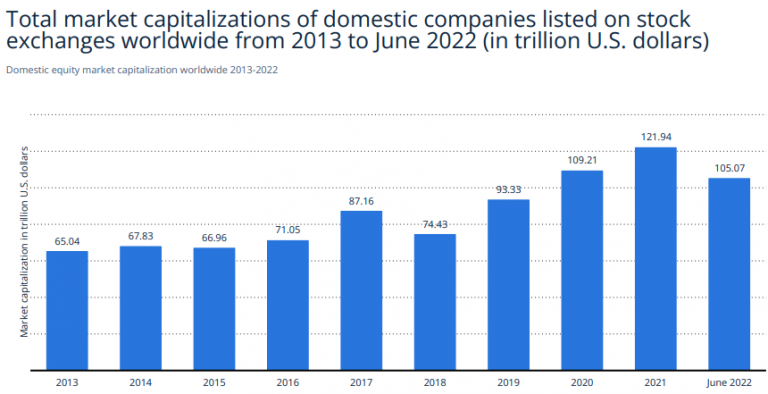

Source: Statista

The global domestic equity market has gone through the roof. In just eight years, it went from being worth 65.04 trillion dollars in 2013 to an eye-watering 121.94 trillion dollars in 2021. And get this, as of June 2022, the total market capitalisation of domestic companies listed on stock exchanges around the world hit a staggering 105.07 trillion dollars.

Even with this economic growth in these years, it will slow this year. Inflation and the war in Ukraine are weighing heavily on the global economy today. Despite these headwinds, the outlook is less gloomy than in the October forecast and could represent a turning point, with growth bottoming out and inflation falling. While we have reflected on how bad the technology sector is, it is worth noting that international markets have been resilient and there was moderate growth in the third quarter of last year: great resilience in labour markets, energy adaptation in record time by Europe stemming from the Russia problem.

As a result, we have slightly increased our growth forecasts for 2022 and 2023. Global growth will slow from 3.4% in 2022 to 2.9% in 2023, before picking up to 3.1% in 2024.

The Impact of Economic Uncertainty

It is not surprising that companies, seeing profits eroded and suffering a market contraction in a short period, 90% of companies plan to cut unnecessary spending on new products. This will put even more pressure on sales teams, who are feeling the pressure to hit quotas.

Strategies to Overcome Tech Company Revenue Growth Headwinds

Despite the challenges facing tech companies in 2023, there are strategies that companies can adopt to overcome these headwinds and continue growing their revenue. One of the most effective strategies is to invest heavily in research and development. Companies that innovate and develop new products and services are more likely to succeed in a rapidly changing market. In addition, with the rise of AIs, the focus of marketers will shift to educating consumers about the value proposition of their products and how these will help them achieve their long-term goals. This can help companies build consumer trust and loyalty.

Conclusion

In conclusion, tech companies face several challenges in 2023 that could impact their revenue growth. These include the need to continually innovate, growing global economic uncertainty, competition from established players and changing consumer behaviours. However, companies that are aware of these challenges and take proactive steps to address them can continue to grow their revenue and succeed in the years ahead.